EB5 Energy - Anadarko Project I

Oklahoma

EB5 Energy - Anadarko Project I

Investment Highlights

Area Invested In

Rural

I-526E Processing

Priority

Investment Amount

$800,000

Administrative Fee

$80,000

I-956F Project Application

Approved

Total EB-5 Raise

$20,000,000

Total Project Cost

$28,000,000

Repayment Term

3 Years

Required Jobs

250

Estimated Jobs

302

Investment Type

Equity

Equity Return

35% of Profits

Project Description

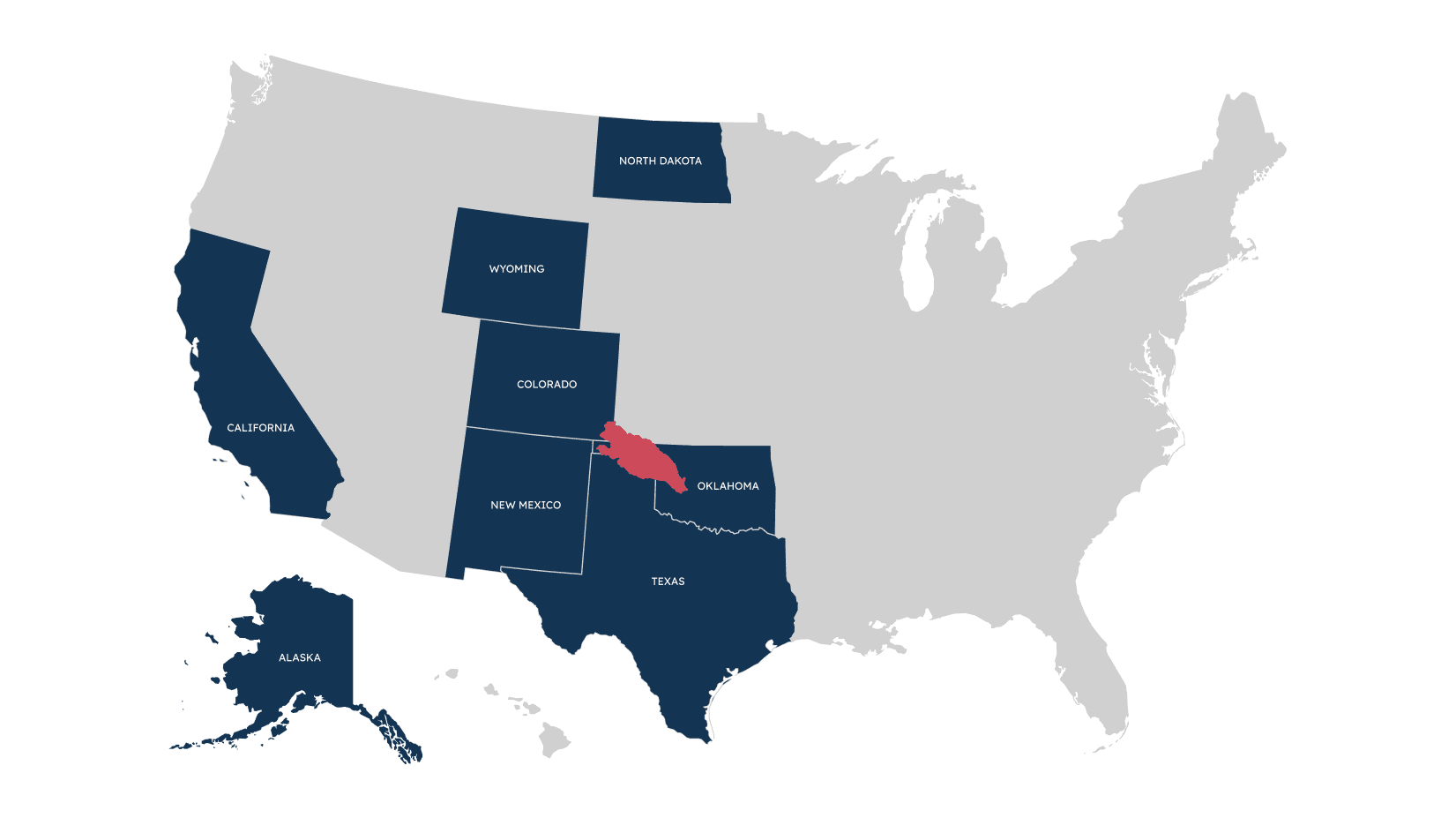

EB5 Energy is financing the redevelopment of existing oil and gas wells in Oklahoma’s Anadarko Basin, one of the most prolific energy-producing regions in the U.S. The project focuses exclusively on wells with proven reserves, using horizontal drilling technology to increase recovery and production efficiency. With mineral rights and drilling permits already secured for the first eight wells, operations are positioned to begin quickly. Production is expected to start within three months of drilling, with oil and gas sold directly into established markets, generating immediate cash flow.

The offering aims to return investor capital through a refinance or sale after 3 years, but repayment cannot be guaranteed. All investments carry risk, including potential loss of capital.

Why Invest

EB5 Energy offers investors the immigration benefits of a rural TEA project, including the reduced $800,000 minimum investment, visa set-asides, and priority processing. The project has received USCIS I-956F approval, and two investor I-526E petitions have already been approved, providing added confidence in immigration outcomes. From an investment standpoint, EB5 Energy focuses only on wells that have already demonstrated significant oil reserves, reducing exploration risk. By applying modern horizontal drilling techniques in the Mississippi Lime formation, production can yield several times more oil and gas than the original vertical wells. With a three-month timeline from drilling to revenue and an established market for petroleum products, cash flow begins quickly and is reinvested into additional wells before investor repayment after three years.

Proven Oil and Gas Reserves

The project focuses exclusively on wells with proven reserves—resources already identified and highly certain to be recoverable. By targeting proven reserves, the project avoids exploration risk and relies on assets with established production potential.

Horizontal Drilling in the Anadarko Basin

Using horizontal drilling and hydraulic fracturing in the Mississippi Lime formation, production rates can be several times higher than traditional vertical wells. This proven technology enhances efficiency, increases recovery, and accelerates the timeline to revenue.

USCIS Approval and Projected Job Creation

The project has received USCIS approval, with two I-956E investor petitions already approved. Job creation is directly linked to drilling expenditures, which have a well-established correlation under USCIS economic methodology. While oil price fluctuations could affect timing, reinvestment of production revenue into additional wells supports the project’s ability to satisfy all EB-5 job requirements.

Secured Mineral Rights and Permits

Mineral rights and drilling permits for the first eight wells have already been secured, allowing operations to begin without delay. This supports timely job creation and reduces execution risk.

Proven Oil & Gas and EB-5 Expertise

The management team has drilled more than 3,000 wells and brings decades of petroleum engineering and geology expertise. In addition, EB5 Energy’s leadership has extensive EB-5 industry experience, ensuring both operational discipline and immigration compliance.

Three-Year Repayment Horizon

Production begins within two to three months of drilling, creating immediate cash flow that is reinvested into additional wells. Investor repayment is scheduled to begin after a three-year cycle, with repayments made in order of subscription.

Project Features

Use of Funds

EB-5 capital funds drilling and reworking of wells in the Anadarko Basin, with expenditures tied directly to job creation under USCIS methodology.

Job Creation

Jobs are calculated from drilling expenditures, a proven USCIS method. Reinvestment of revenue into new wells supports continued job creation.

Market Demand

The Anadarko Basin is a mature energy region with proven reserves and extensive infrastructure. Oil and gas are transported through pipelines and trucks into established markets, with strong domestic demand supporting long-term production.

Immigration Considerations

The project has I-956F approval, with two investor petitions approved. As a rural TEA, it qualifies for set-aside visas and priority processing.

Management

Spire Asset Management leads operations with decades of petroleum engineering and EB-5 program expertise.

Location

The Anadarko Basin in Oklahoma is one of the most prolific U.S. oil and gas regions, supported by proven reserves and existing infrastructure.

Exit Strategy

Repayment is targeted after three years, supported by production revenue and reinvestment into additional wells. Repayments follow subscription order.

Risk Factors

Risks include oil price volatility and drilling delays. These are somewhat mitigated by targeting proven reserves and using established drilling methods.

Disclosure

*Job cushion is based on a projected job creation estimate provide by Vermillion Consulting and does not guarantee the success of the investment nor the success of obtaining permanent residency.

This is not an offer to buy or sell securities, which is done by offering memorandum or prospectus only. All investments involve risk. You may lose part or all of your investment. This is not a recommendation, investment advice, or solicitation to sell or buy securities and is not provided in a fiduciary capacity. It does not account for specific investor objectives or circumstances or suggest a course of action. Investment decisions should be made based on an investor’s objectives and circumstances and in consultation with their advisors. This material may contain forward-looking statements that are not guarantees of future performance; actual results may differ from any forward-looking statements. This content is not tax advice; prospective investors should confer with a tax advisor for tax advice. Securities are offered through Nortlov Securities, LLC (“Nortlov”), a registered Broker-Dealer and member of FINRA (http://www.finra.org/) MSRB (https://ww.msrb.org) and SIPC (http://www.sipc.org/). You can review the broker check for Nortlov at (https://brokercheck.finra.org/firm/summary/318546). Nortlov Securities, LLC is not affiliated with EB5 Marketplace.