Elemente Casa Grande

Casa Grande, Arizona

Elemente Casa Grande

Investment Highlights

Area Invested In

High Unemployment

I-526E Processing

Standard

Investment Amount

$800,000

Administrative Fee

$80,000

I-956F Project Application

Approved

Total EB-5 Raise

$20,000,000

Total Project Cost

$72,700,000

Repayment Term

3 to 4 Years

Required Jobs

250

Estimated Jobs

872

Investment Type

Fully Secured Preferred Equity

Preferred Return

2.5% to 4% per annum

Project Description

Elemente Casa Grande is a build-to-rent residential community located in Casa Grande, Arizona, part of the rapidly growing Phoenix metropolitan area. The development will feature 238 single-family rental homes across a 21.6-acre site, designed with a mix of one-, two-, and three-bedroom layouts. Residents will have access to modern amenities, including community gardens, outdoor recreation areas, a dog park, and electric vehicle charging stations. The community emphasizes long-term livability and sustainability, incorporating solar energy, water-saving fixtures, and green construction materials to meet consumer demand for environmentally conscious housing.

The offering aims to return investor capital through a refinance or sale after 3-4 years, but repayment cannot be guaranteed. All investments carry risk, including potential loss of capital.

Why Invest

The Phoenix–Mesa–Chandler metropolitan area is one of the fastest-growing regions in the United States, with high rental housing occupancy and steadily rising rental rates. Casa Grande, positioned between Phoenix and Tucson, has become a strategic employment hub with major investments from Lucid Motors, Nikola, and other large employers, driving population and housing demand. Elemente Casa Grande is being developed by Lincoln Property Company, an institutional-grade developer with more than 50 years of experience and over 209,000 multifamily units built nationwide. The project is expected to generate approximately 870 jobs, more than three times the number required for EB-5 investors, and has multiple exit pathways through refinancing or sale to institutional investors seeking stabilized rental communities.

Growing Rental Housing Demand

Casa Grande, part of the fast-growing Phoenix metropolitan area, has experienced rapid population and employment growth that has outpaced local housing supply. Major employers such as Lucid Motors, Nikola, Abbott, and Frito-Lay are fueling demand, while the city’s rental vacancy rate remains under 5%. Elemente Casa Grande will deliver 238 new rental homes to meet this unmet need for professionally managed housing designed for long-term renters.

Experienced National and Local Developers

The project is led by Lincoln Property Company, a national developer with more than 50 years of experience, 209,000 multifamily units developed, and $82 billion in managed assets. In partnership with Larson Development Group, an Arizona-based developer with over $5 billion in completed projects, the team brings a combination of institutional strength and local execution expertise.

248% Job Cushion Based on Construction Spending

Elemente Casa Grande is projected to create approximately 870 jobs, compared with the 250 required for 25 EB-5 investors. This results in a job creation cushion of 248%, providing a significant margin of safety for EB-5 immigration requirements.

Structured to Support Repayment

EB-5 investor capital is structured as a five-year investment, with repayment expected through refinancing or sale once the project reaches stabilization. Financial projections are based on conservative lease-up and occupancy assumptions. At completion, the project’s value is projected to increase from $72.7 million in development cost to $92.6 million, with a further increase to $95 million by year five of operations.

Thoughtfully Designed Townhomes for Modern Renters

The community will feature townhome-style rental units with layouts that appeal to families, professionals, and retirees. Each home is designed with functionality, privacy, and storage in mind, supporting long-term occupancy. The project also incorporates sustainable features such as solar energy, water-efficient systems, and green building practices, aligning with consumer demand for environmentally conscious housing.

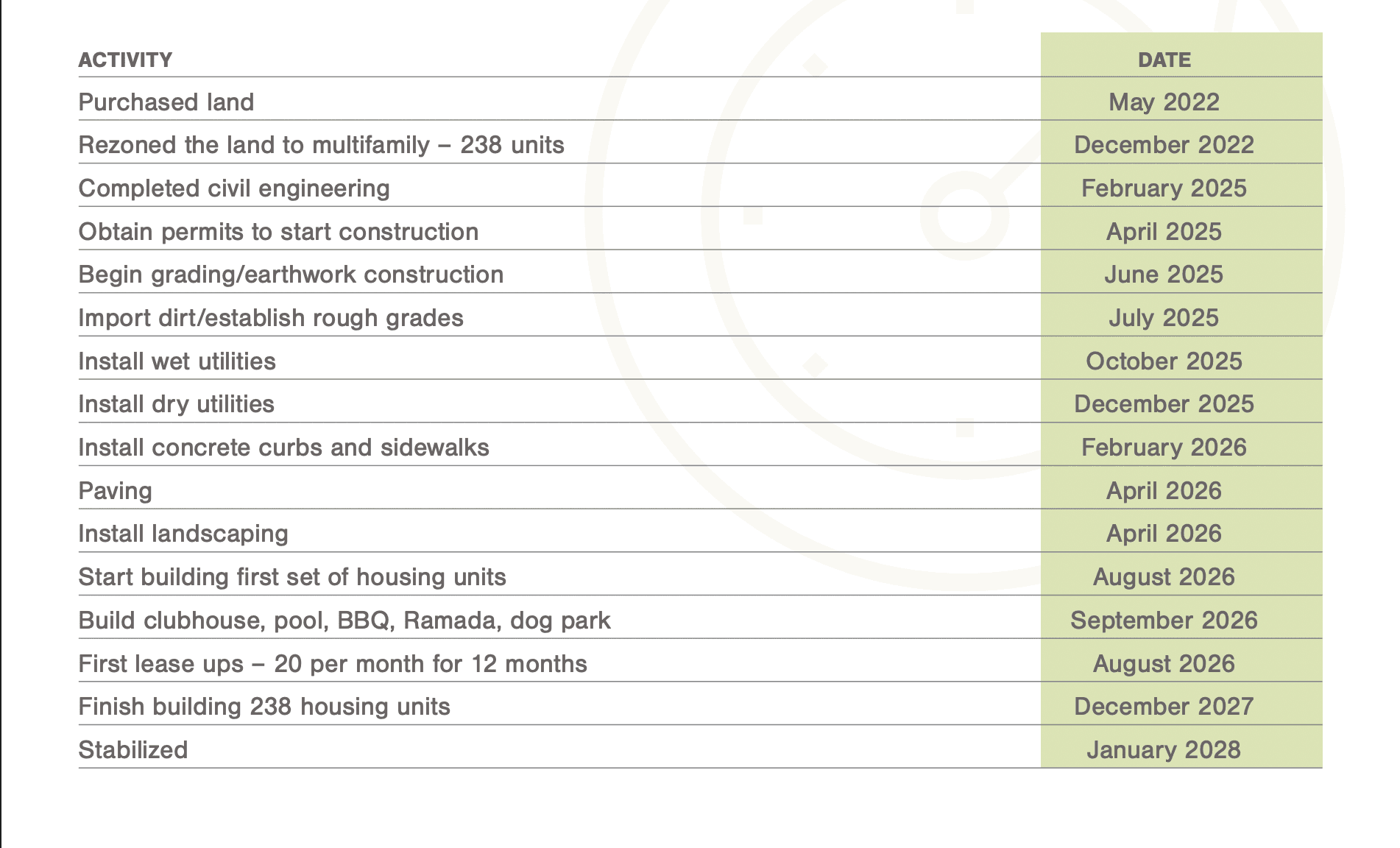

Project Timeline

The project began with land acquisition in May 2022, followed by rezoning, engineering, and permitting, which were completed in July 2024. Construction is scheduled to start in August 2024, with completion of homes and community amenities expected by December 2025. Leasing will begin in February 2026, and the project is projected to achieve full stabilization by June 2027.

Project Features

Use of Funds

Investor capital will fund land development, construction of 238 rental homes, and amenities, while also replacing short-term bridge financing.

Investment Terms

The minimum investment is $800,000, structured as equity. The EB-5 raise targets $20 million from 25 investors with a projected five- to six-year term.

Job Creation

The project is expected to create 870 jobs, providing a 248% job cushion above the 250 jobs required for 25 EB-5 investors.

Market Demand

Casa Grande’s population and employment growth, combined with rental vacancy rates below 5%, drive strong demand for new rental housing.

Immigration Considerations

The project qualifies as a high unemployment TEA and has filed an I-956F with USCIS, making it eligible for visa set-asides.

Management

Lincoln Property Company and Larson Development Group bring institutional experience, with over $87 billion in managed assets and $5 billion in completed projects, respectively.

Location

Casa Grande, situated between Phoenix and Tucson, is a regional hub for advanced manufacturing and logistics with major employers nearby.

Exit Strategy

Repayment is expected through refinancing or sale of the stabilized property to institutional investors active in the build-to-rent sector.

Risk Factors

Construction costs, market shifts, or immigration policy changes pose risks, mitigated by an experienced development team, strong demand, investor appetite, and a 248% job cushion.

Disclosure

This is not an offer to buy or sell securities, which is done by offering memorandum or prospectus only. All investments involve risk. You may lose part or all of your investment. This is not a recommendation, investment advice, or solicitation to sell or buy securities and is not provided in a fiduciary capacity. It does not account for specific investor objectives or circumstances or suggest a course of action. Investment decisions should be made based on an investor’s objectives and circumstances and in consultation with their advisors. This material may contain forward-looking statements that are not guarantees of future performance; actual results may differ from any forward-looking statements. This content is not tax advice; prospective investors should confer with a tax advisor for tax advice. Securities are offered through Nortlov Securities, LLC (“Nortlov”), a registered Broker-Dealer and member of FINRA (http://www.finra.org/) MSRB (https://ww.msrb.org) and SIPC (http://www.sipc.org/). You can review the broker check for Nortlov at (https://brokercheck.finra.org/firm/summary/318546). Nortlov Securities, LLC is not affiliated with EB5 Marketplace.