Hidden Hills Vistas

Investment Highlights

Area invested In

Rural

I-526E Processing

Priority (est. 3 to 8 months)

Total EB-5 Raise

$72,000,000

Total Project Cost

$115,456,103

Investment Amount

$800,000

Investment Term

3 Years + 2 one-year extension options

Preferred Return*

1% first 3 Years; 3% year 4; 5% year 5

Required Jobs

900

Estimated Jobs

1,141

Job Cushion**

27%

Luxury rural retreat in ideal location with EB-5 investors first in capital stack

Seven Hills Hospitality leads the development and operation of a 37-acre luxury mountain resort in Gatlinburg, Tennessee, adjacent to the Great Smoky Mountains National Park, the country’s most visited national park. The Project plans to build 95 mountain cabins and chalets, each with two to eight bedrooms, with best-in-class amenities, including pools, a restaurant, 12,000 square feet of retail space, and hiking trails. Rural qualification and first position in the capital stack will interest investors looking for faster processing and financial security.

Why Invest

This luxury rural project offers the fastest EB-5 processing possible and reserved visas that are immediately available for investors from any country, including China, India, and Vietnam. It boasts an ideal location next to America’s most visited national park* and a picturesque town that attracts many of the millions of park visitors each year. With best-in-class amenities including sustainable features, it is perfectly situated to attract the luxury and eco-conscious outdoor-retreat market. EB-5 investors may be excited by the projected 3-year repayment and take comfort in the fact that EB-5 capital holds first position for repayment in the capital stack. An experienced management team has worked with EB-5 capital in the past, with 100% approval rate for all previously processed EB-5 investors, and has significant experience in developing this kind of project. The project is progressing well with the first phase of the project expected in the first half of 2024. * Great Smoky Mountain National Park statistics: https://www.nps.gov/grsm/learn/management/ves.htm

Wide range of luxury units

The accommodations will cover a wide range, from 2-bedroom to 8-bedroom units, with an emphasis on providing 4-bedroom or larger cabins. Cabin sizes vary between 1,000 and 6,400 square feet. Each cabin will offer amenities such as private pools, hot tubs, game/media rooms, and at least two private parking spaces, along with modern conveniences like contactless mobile check-in.

Stunning design and amenities

Large picture windows and vaulted ceilings enhance the breathtaking views. The interior design will be clean and modern, featuring earth tones and natural light. Amenities include fireplaces, high-end countertops and appliances and a combination of wood and ceramic flooring. Outside, the cabins will have hot tubs and multiple decks. Select larger units will offer private swimming pools, fitness centers, theater rooms, outdoor kitchens, and game rooms with pool tables.

Guest amenities and retail facility

The Project will enhance the guest experience with additional amenities. A scenic hiking trail winds throughout the entire property. 2 heated outdoor pools will be accessible to all guests. Close to the cabins, there will be a 12,000-square-foot retail facility, which includes a restaurant operated by the JCE, and spaces for retail leasing. Prospective tenants being considered include a virtual TopGolf Swing Suite for a thrilling interactive golf experience.

Leveraging record numbers for America’s most popular national park

Hotels benefit from rising domestic and international tourism, especially after lifting pandemic restrictions which boosted revenues significantly. Boutique hotels are growing faster due to their unique offerings. The Great Smoky Mountains National Park, the most visited in the U.S. with 13.3 million visitors in 2023, saw a 42% increase in visitation over the last decade. Communities within a 60-mile radius of the park saw a 61.5% jump in tourist spending from 2021 to 2022, with nearly $1 billion of the $2.1 billion spent on lodging. Gatlinburg, close to the park, is ideally situated to cater to the demand for luxury mountain resort experiences.

Ideal location, close to top attractions and transportation

Located at 1625 Hidden Hills Road, Gatlinburg, Tennessee, the Project is on a 37-acre site with direct access via US Highway 321 and Hidden Hills Road, about 40 miles from the Knoxville airport. Despite its small population, Gatlinburg is the third most-listed city in the state, thanks to its proximity to Great Smoky Mountains National Park, which recorded 17.7 million visitors in 2023. Additional nearby attractions include Downtown Gatlinburg, Rocky Top Sports World, Pigeon Forge, Dollywood, Ripley’s Aquarium, and the Gatlinburg SkyLift.

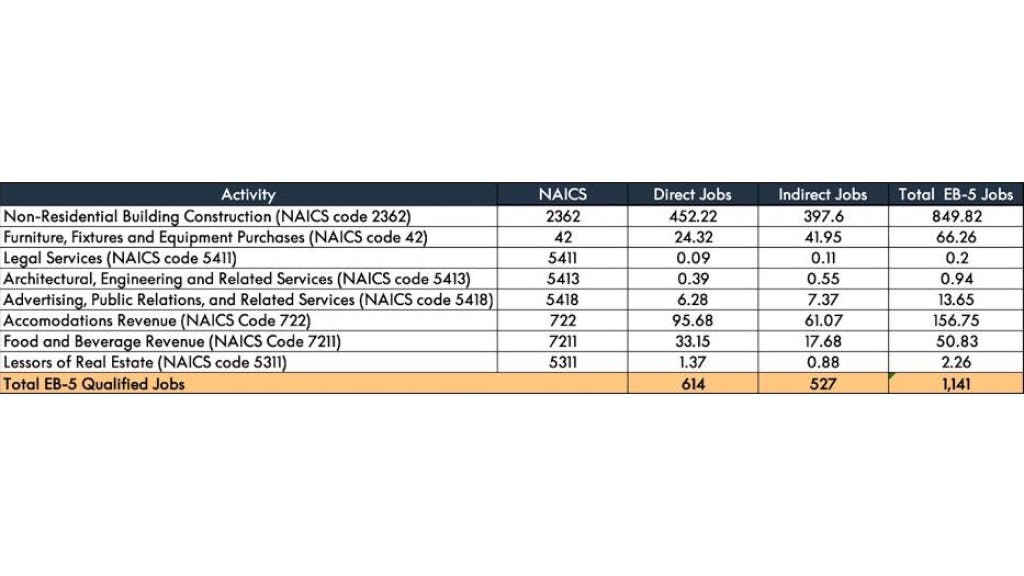

1141 total jobs and 614 direct jobs

The Project expects to create 1,141 jobs for 90 investors resulting in a job cushion of 27%.**. Fundamental data and forecast supplied by management of the Company. Such projections may not be realized. Job-creation data source: Information provided by EB5 Marketplace.

EB-5 investors in 1st repayment position

The Project aims to raise up to $72 million from 90 EB-5 investors. Initially, $14.5 million of EB-5 capital will repay senior bridge loans from Citizens National Bank; after this event, the EB-5 capital holds senior repayment position. This investment starts as preferred equity and converts to a loan once it reaches $14.5 million. Current project equity is over $18 million. The owner may offer further financial support if necessary. If the entire $72 million is not raised, the JCE may sell some assets to continue development.

Revenue from 3 main sources

Revenue streams for the Project are expected to arise from three primary sources: room rentals, retail space leasing, and restaurant operations. Detailed financial projections for each of these components are presented in the images below, in addition to the combined pro forma of all segments.

In line with planned timeline

Excluding initial site work, the entire construction process is anticipated to span approximately 55 months. Site preparation began in the fourth quarter of 2021, marking the start of the Project's physical development. Approval for the construction of the first 10 units has been secured, indicating progress in line with the planned timeline and milestones for the Project. For the first 10 units, they have secured the required entitlements, and building permits. Vertical construction on these units initiated in the second quarter of 2023. These units are expected to be ready for rent by the fourth quarter of 2024. The Project is projected to reach completion by the summer of 2027.

Strengths

Reserved visas and priority processing

Secure a reserved visa and benefit from expedited processing times of 3-8 months for approved rural investors.

Top-priority lien position

EB-5 investors hold the most senior lien position with land, project, fund, and income as collateral, ensuring top-priority security.

Strong owner financial commitment

The project owner has demonstrated significant commitment, contributing $5,215,000 to date and pledging an additional $5,280,000.

Significant construction advancements

Major progress with bridge loans funding horizontal construction and 7 cabins, with $11.7 million invested by December 2023.

Disclosure

Preferred returns are part of the deal structure and indicate the sequence of how distributions (from operations or a capital event) are disbursed. They are not guaranteed and should not be considered a financial projection. Actual cash flow and/or distributions from the Company may differ from the preferred return. If the Company's net cash flow falls short of covering the preferred returns owed, any outstanding balance will accrue until there are adequate funds or proceeds from a capital event to fulfill the annual return obligations. The Company's Manager reserves the right to withhold all net operating cash flow earmarked for investors, opting instead to accumulate these funds until the repayment of Capital Contributions. Investors should review the PPM and the respective offering documents from the Company for full details. *Job cushion is based on a projected job creation estimate only and does not guarantee the success of the investment nor the success of obtaining permanent residency.

Disclaimer

EB5 Marketplace is not a registered broker-dealer, and Pinnacle Capital Securities and EB5 Marketplace are separate, unaffiliated entities. Pinnacle Privacy Policy | Pinnacle Business Continuity Plan | Pinnacle Form CRS | FINRA Broker Check | https://eb5marketplace.com (the "EB5 Marketplace Website") is a website operated by EB5 Marketplace, a privately held company. EB5 Marketplace provides informational purposes only and does not offer to sell nor solicit an offer to buy any security that may be referenced herein.